Posts by Jason McConkey

7 simple ways to manage stress in a busy world

The power of pension tax relief and how it could boost your retirement income

7 motivational tips to help keep your 2026 goals on track

7 ways financial planning could help you set realistic goals

The signs you could be experiencing impostor syndrome and 6 ways to overcome it

How money causes anxiety and 3 tips to reduce it

Your Autumn Budget update, and what it means for you

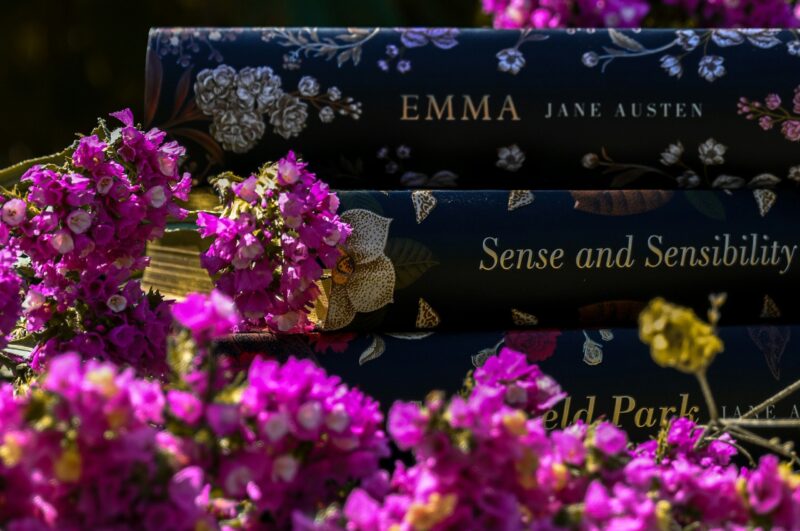

Guide: 5 enduring money lessons you can discover in Jane Austen’s novels

In life, the finest wisdom often comes from the most unexpected places. You might even discover financial insights in the pages of Jane Austen’s novels. Read this useful guide to uncover enduring lessons in Northanger Abbey, Pride and Prejudice, and other works by the celebrated author.

The difficult but important estate planning conversations to have with your family

Once you’ve created an estate plan, you might want to talk to your family about the decisions you’ve made. While these conversations can be difficult, they’re important and could ensure everyone is on the same page.

Investment market update: October 2025

Markets reached record highs in October 2025 despite ongoing uncertainty and disappointing economic data in some regions. Find out what may have affected the performance of your investments.

What donating blood tells us about money

Examining what motivates people to donate blood can provide interesting insights into how you could boost your financial wellbeing. The key to making financial decisions that support your wellbeing could be finding your purpose.

Phasing into retirement: The flexible options you might consider

Almost half of workers aged over 50 are already phasing into retirement or would like to do so in the future. Find out why a gradual approach to retirement could be attractive, along with some of the options that could allow you to do so.